Company History and Family History

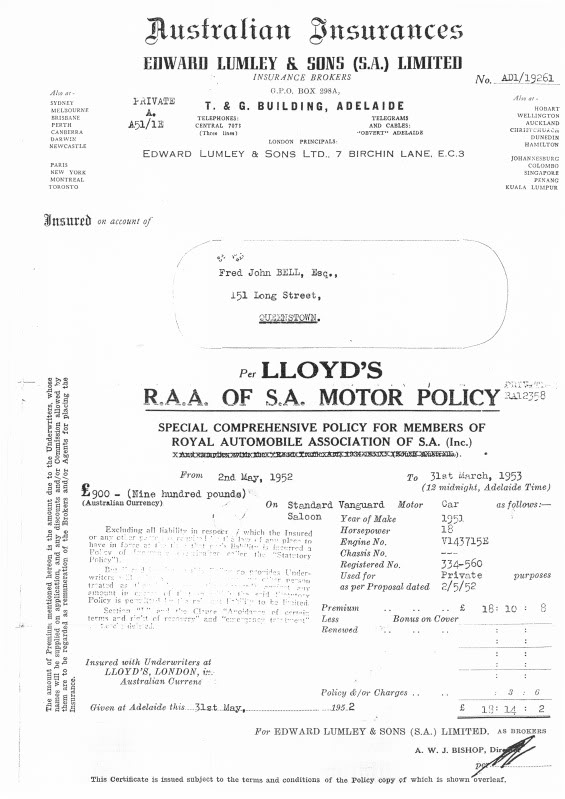

In 1921 Edward travelled to Australia starting in Perth and arranged meetings with prominent business people and explained that Lloyd’s market was outside the tariff to which all companies subscribed and could quote cheaper rates. However he suggested to a number of businesses that they would be better able to get cheaper rates if they formed an Association which vetted the membership and ensured that only reputable firms joined so that the lower rates could be justified and maintained in the future. This approach went well especially that the commission earned by the Association would help to fund the Association. Jewellers and new motoring organisations took this up and insured at Lloyd’s. He returned home with enough business to pay for the fare home which he did not have when he arrived.

In the 1960’s it became clear that the partnership model with a central company owning the assets was becoming less viable both on business placed in London and with Security and General so Sir Robert Crichton-Brown who was Chairman of Security and General persuaded the partners to become part of an overall company in exchange for shares in Security and General which was floated on the Sydney Stock Exchange with Edward Lumley Holdings owning 55% of the shares. The listed company was called Edward Lumley Ltd and was at its height a top 150 public company in Australia.

During the 1970’s and 1980’s the competition from other brokers became more focused with them having access to Lloyd’s as well as the Tariff Companies which we could not use as we were considered non-tariff. Slowly the strategy developed of using the Security and General to compete in the local market through local brokers. Being aware of how Lloyd’s brokers worked we were able to give a quicker and comprehensive quotations as well as a claims service and advice to clients on how to reduce their claims.

By 1987 a block of shares of about 28% had been acquired by a third party who in their other businesses had run into difficulties and they were wishing to sell their Edward Lumley Ltd shares. In order to acquire these shares it was necessary to make an offer for all outstanding shares. This was done by the London company Edward Lumley Holdings Ltd making an offer and acquiring 100% of the shares.

As the company gained strength it was successful in underwriting at a combined loss ratio well below most competitors by managing its costs. It was writing business from brokers and could decline those risks which were not likely to produce a profit. Being now a wholesale market for brokers it was harder to be in the broker market and competing at that level as well. Consequently the broking business was sold to AON both in Australia and South Africa.

These changes had a profound effect on the London Company which had become much smaller with only UK business left. Lumley House was sold in 1988 and redeveloped. It had become outdated because of computer wiring needs and lack of air conditioning.

Following the sale of Lumley House Edward Lumley Holdings moved to 41 Tower Hill for 5 years being Hambro’s Bank building. This was the head office of the Group and included the UK businesses being the vehicle warranty business in Coventry and Letsure in Maidenhead. The next move was to 99 Bishopsgate in September 1996.

In 2003 a strategic review indicated that the Australian and New Zealand Insurance companies would need extra capital if they were going to continue to grow. Already a good deal of profit was being paid away to quota share reinsurers to ensure sufficient capital for business currently being written. The options were to float again and loose control over time or to sell. After careful consideration Richard and Henry felt that the second option would produce the best option going forward as with our large families having all the family wealth in one insurance company which would always be subject to volatile returns. The nature of insurance did not seem to be the best option for the next generations. As a good price was obtainable and the UK businesses would be retained the sale to Westfarmers went ahead in 2003. That they valued the goodwill and standing of the business with brokers in the Australian and New Zealand market is shown by the fact they have continued using the Lumley name.

With the increased reliability of motor vehicles the potential of motor warranty business declined and a sale of the Coventry business took place in 2006. The Maidenhead business became the object of desire from a competitor who was prepared to offer a price we could not refuse but unfortunately this competitor had not made real plans on how to manage the merger and in any case ran into difficulties and was broken up.

Whilst in many ways it was disappointing to sell what had been built up as a great insurance business which had adopted to changing circumstances the next step would have required new management and capital producing an unknown risk and loss of control. As it is the family have an investment portfolio which has a known return with a lower risk factor to family members and should allow them to plan their lives accordingly.